Torch Funds

about the program

The Torch Fund program is an experiential learning opportunity for finance students within the University of Tennessee’s Haslam College of Business.

Managing a real-life portfolio

Our goal is to use portfolio management as a sandbox to develop critical thinking skills, written and oral communication skills, technical skills (e.g., Bloomberg and Excel) and knowledge of capital markets. As a result, our student managers experience where the rubber meets the road, by applying knowledge and skills from the classroom toward managing a real-life portfolio of real cash and securities.

While many Torch alumni go on to careers in the investment field, Torch offers a substantial growth opportunity for students pursuing any finance area (e.g., investment banking, consulting, corporate finance, etc.). Rather than learning via lectures and exams, students learn by doing. In a rigorous environment where subject matter expertise comes through independent research, ideas are presented and debated among peers in our weekly meetings.

Torch Fund is considered a finance elective and student managers receive a total of three credit hours upon completing their tenure.

Undergraduates: FINC495

MBAs: FINC595

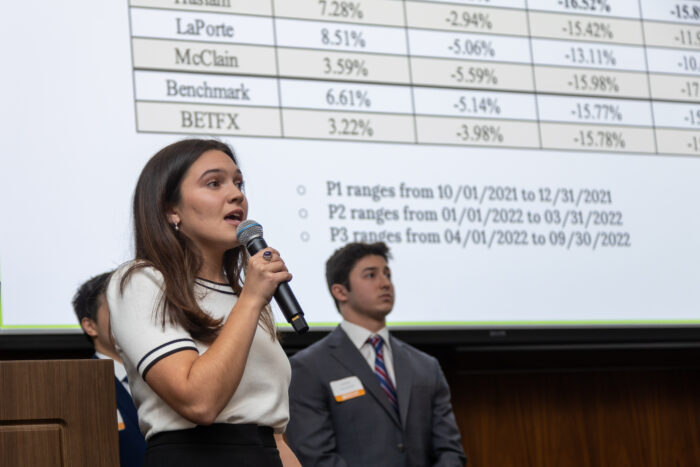

Undergraduate and MBA students work side by side toward the shared goals of growing their portfolio, outperforming their benchmark and generating returns that are superior to those of other teams. Our top-down wealth management portfolios use a weighted average of the S&P 500 and Barclays U.S. Aggregate Bond Indicies as their primary benchmark. Our bottom-up value investing portfolio uses the Russell 3000 Value Index as its primary benchmark. Students’ individual performance is evaluated through instructor and peer assessments of their individual contributions.

Experiential Learning

Student managers rely heavily on Bloomberg software and data to conduct their duties as portfolio managers and analysts, leveraging resources and support provided by the Masters Investment Learning Center (MILC). Each portfolio team has a dedicated Bloomberg terminal available exclusively to their team.

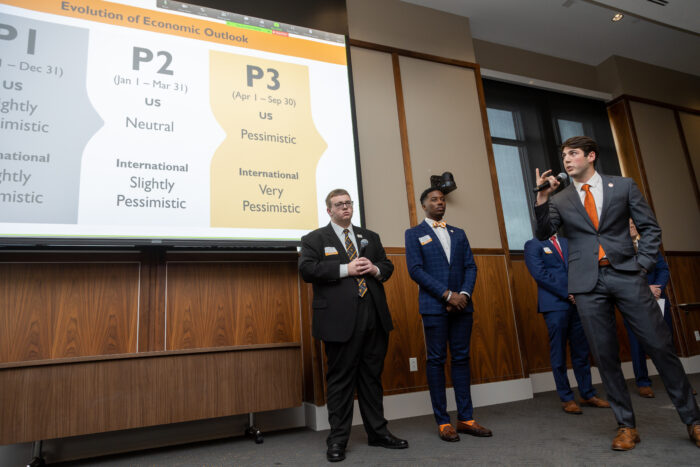

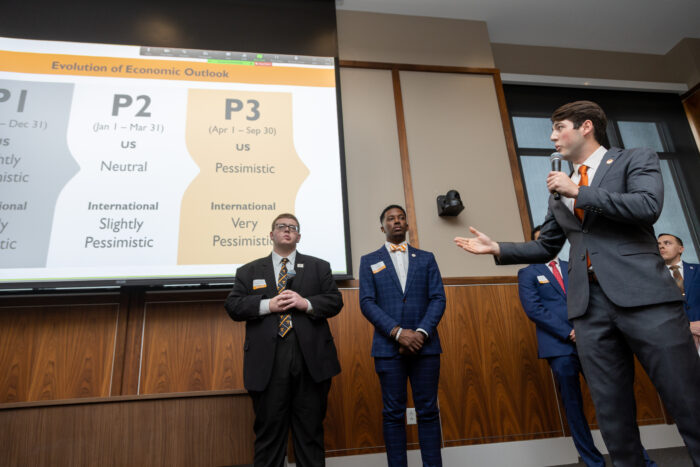

Students serve as both analysts and portfolio managers during their two-semester tenure period, and are assigned into one of our four portfolio teams for the duration of their tenure. Each portfolio practices either a top-down wealth management approach or a bottom-up value investing approach. Portfolio performance is evaluated regularly and communicated to our donors and other stakeholders through periodic performance reports, in addition to an annual performance presentation for our donors, advisory board and other invited guests.

Torch Funds

Gallery