PUBLICATIONS & RESEARCH

Use the search field below to find Boyd Center for Business & Economic Research publications by title, author, or date of publication.

Tennessee Business Leaders Survey, Winter 2024

Publication Date: February 23, 2024

Many business leaders from across Tennessee responded to the Boyd Center’s semi-annual Business Leaders Survey, providing a unique perspective on the Tennessee and U.S. economies. Responses were provided between January 10 and January 31, 2024. Respondents represent a broad sample of Tennessee’s businesses, both by size and by industry.

Going Beyond Free College: Initial Findings on College Success with Supplemental Coaching and Grants

Publication Date: February 14, 2024

We examine the relationship between short-term success in college and student take-up of supplemental coaching and financial aid. These extra supports were made available to some students participating in Tennessee’s “free community college” program starting in fall 2018. We use residence, income, and other eligibility criteria to understand how coaching and additional grants are associated with persistence into a second year of college, or receipt of an early college credential in the first year. Results indicate that students who were more engaged with their coaches were significantly more likely to re-enroll in college for a second year or complete an early credential. Students who received supplemental grants, often for emergencies or unanticipated expenses, were not more or less likely than others to persist into a second year of college or earn an early postsecondary credential.

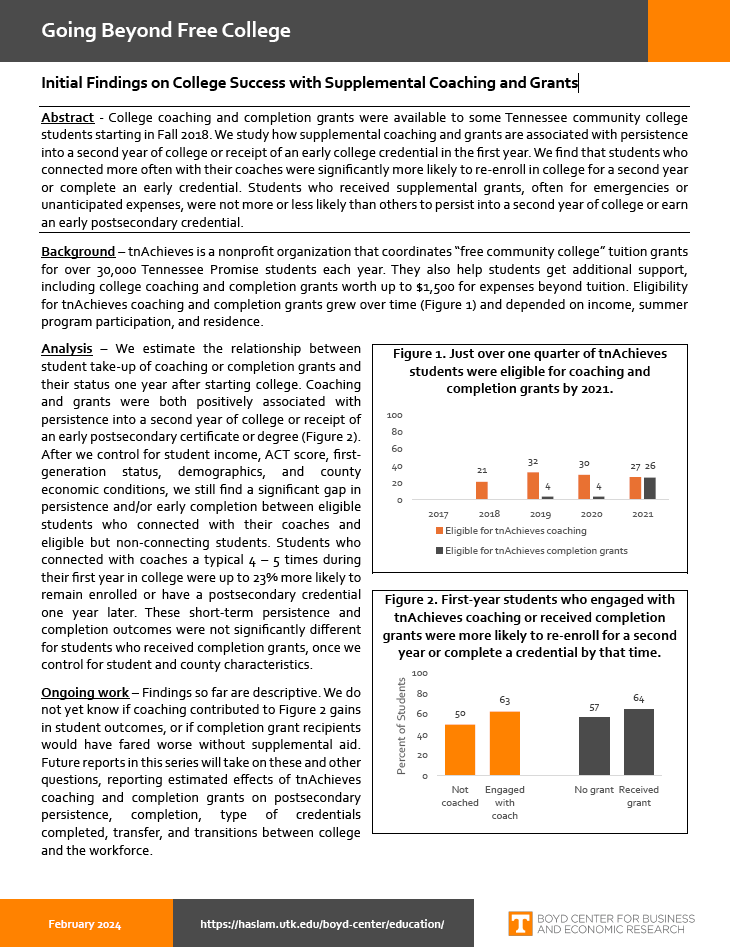

FACT SHEET: Going Beyond Free College

Publication Date: February 14, 2024

College coaching and completion grants were available to some Tennessee community college students starting in Fall 2018. We study how supplemental coaching and grants are associated with persistence into a second year of college or receipt of an early college credential in the first year. We find that students who connected more often with their coaches were significantly more likely to re-enroll in college for a second year or complete an early credential. Students who received supplemental grants, often for emergencies or unanticipated expenses, were not more or less likely than others to persist into a second year of college or earn an early postsecondary credential.

An Economic Report to the Governor of the State of Tennessee, 2024

This 2024 volume of An Economic Report to the Governor of the State of Tennessee is the forty-eighth in a series of annual reports compiled in response to requests by state government officials for assistance in achieving greater interdepartmental consistency in planning and budgeting efforts sensitive to the overall economic environment. Both short-term, or business cycle-sensitive forecasts, and longer-term, or trend forecasts, are provided in this report. The report’s special section provides an assessment of business formation in Tennessee. The Tennessee forecast in Chapter 2 provides an in-depth look at the state’s housing and rental markets.

The Impact of TennCare: A Survey of Recipients, 2023

Publication Date: November 27, 2023

The Boyd Center for Business and Economic Research at the University of Tennessee, under contract with the Department of Finance and Administration of the State of Tennessee, conducted a survey of Tennessee residents to ascertain their insurance status and use of medical facilities and their level of satisfaction with the TennCare program. A target sample size of 5,000 households allows us to obtain accurate estimates for subpopulations. The Boyd Center prepared the survey instrument in cooperation with personnel from the Division of TennCare.

Knox Promise: College Persistence and Completion for the First Three Cohorts

Publication Date: October 27, 2023

Knox Promise provides coaching and need-based financial aid to Knox County high school graduates who enroll in community and technical colleges as Tennessee Promise students. In this report, we review college persistence and credential completion for the first three cohorts of students participating in Knox Promise. These students entered college in fall 2019, 2020, and 2021, navigating different phases of the COVID-19 pandemic and the shift to and from largely online learning. Available data allow us to summarize enrollment and completion up to 3 years after they started college.

Knox Promise and Nashville Grad: An Early Look at College Outcomes

Publication Date: October 27, 2023

Knox Promise provides coaching and need-based financial aid to Knox County high school graduates who enroll in community and technical colleges as Tennessee Promise students. Nashville GRAD is a similar program for Davidson County students enrolling in Nashville State Community College and TCAT Nashville. In this report, we review college persistence, credit completion, and grade point averages for the first two cohorts of students participating in Knox Promise and Nashville GRAD. Available data allow us to summarize these outcomes for their first 1-2 years of college.

Tennessee Business Leaders Survey, Summer 2023

Publication Date: September 27, 2023

Many business leaders from across Tennessee responded to the Boyd Center’s semi-annual Business Leaders Survey, providing a unique perspective on the Tennessee and U.S. economies. Responses were provided between August 1 and August 23, 2023. Respondents represent a broad sample of Tennessee’s businesses, both by size and by industry.

An Economic Assessment of TennCare Expansion in 2023

Publication Date: March 1, 2023

Expanding TennCare will yield economic benefits in almost every dimension. In the very near future, expansion will have positive fiscal benefits and generate increased economic activity in the state. It will provide vital financial protection for rural hospitals, ensuring rural Tennesseans have access to health care, particularly for time-sensitive emergent conditions. In the longer run, increased eligibility will yield spillover effects to the state in subtle ways but in ways that have immeasurable impact. Expansion can help with the substance use epidemic, reduce disability and permanent exits from the labor force, and reduce rates of chronic illness (or at least empower patients and providers to treat them more efficiently). The program is more than self-funding, and the federal government is willing to provide Tennessee $1.3 billion to pursue an endeavor that yields nothing but benefits on net.

The Value of a College Education in Tennessee

Publication Date: August 9, 2023

The labor market and broader economy remain in flux as the U.S. unevenly rebounds from COVID-19 disruptions to health, education, work, prices, and every aspect of life. One silver lining of these disruptions, for job seekers, has been an exceptionally tight labor market with rising wages and expanding job opportunities. The bottom of the pay scale has risen the most in percentage terms, benefitting jobs that are less likely to require a college education. Is college still “worth it” in this environment?