The summer 2024 Tennessee Business Leaders survey, conducted in August by the Boyd Center for Business and Economic Research at the University of Tennessee, Knoxville, reveals that, while Tennessee business leaders are still grappling with inflation, they believe the situation has slightly improved.

Combating Inflation

Regarding efforts to combat inflation, the survey reveals a nearly 7 percent decline in employers offering higher wages to attract or retain workers. Business leaders surveyed reported an increased use of artificial intelligence by over six percentage points, reaching 56 percent. Additionally, 65 percent said they were pursuing new supply chain opportunities to lower costs, up nearly two percentage points since the winter survey, conducted in January.

Respondents expanded on other actions they were taking against inflation, with some noting they had cut back on expenses, budgeted more tightly, outsourced jobs, shopped for deals on materials and asked employees to pay a larger share of health insurance benefits. A few had cut to a four-day work week to reduce office expenses.

“Inflation has been eating into profit margins for employers and increasing the cost of living for employees across Tennessee and the U.S.,” said Don Bruce, director of the Boyd Center. “It’s good to see business leaders are taking creative measures to improve employee retention and to keep their businesses solvent for years to come.”

Outlook of the National Economy

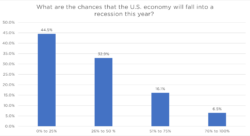

Only 6.5 percent of the business leaders surveyed said they believed there is a chance of recession in the U.S. this year, while over three-quarters considered the likelihood to be less than 50 percent.

There was optimism for an interest rate cut, with two-thirds of respondents accurately predicting that the Federal Reserve would lower rates within three months. That prediction came true in mid-September when the Fed reduced interest rates by half a point.

Business leaders have become increasingly pessimistic about other aspects of the U.S. economy throughout 2024. Just 30 percent of respondents in January thought the economy was worse than it had been a year earlier, but that number grew to 44 percent in August. About 31 percent of August survey respondents said they believed the economy would continue to worsen over the coming year, as opposed to just 22 percent of respondents at the beginning of 2024.

Outlook on Tennessee Economy and Workers

Despite a pessimistic outlook on the U.S. economy, the business leaders surveyed remained optimistic about Tennessee’s business climate. Nine out of 10 said they believed the state’s economy would either remain stable or improve over the coming year, with 50 percent attributing that optimism to strong business investment in Tennessee. One in five cited government leadership as a contributing factor.

In the January survey, nearly 75 percent of respondents had reported an insufficient supply of appropriately trained workers; this figure decreased to 61 percent in the August survey. Over half of the survey respondents recommended that the state prioritize enhancing training and education to expand the workforce. Two-thirds of respondents indicated that their local workforce lacked work ethic, and almost half noted that job applicants had unrealistic compensation expectations or lacked technical skills.

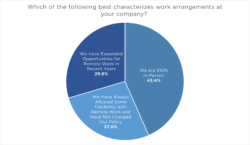

Forty-three percent of respondents said they no longer offered remote work, up from 36 percent in the January survey. Elaborating on their work arrangements, many respondents said hybrid work schedules allowed for better work-life balance and helped attract and retain employees. Others worried about productivity and building team culture, with one respondent saying, “I am concerned about establishing good work habits for new hires straight out of college and developing our future leaders if they have such limited in-person interaction.”

Other Findings Impacting Workers

Approximately 53 percent of survey respondents reported improvements in retention rates and in attracting suitable workers, up from 47 percent in January. The cost of housing remained the most significant factor affecting worker attraction and retention, cited by nearly half of respondents. Additionally, one-third pointed to the cost of childcare services and the availability of housing as challenges for their employees. Nearly half of the respondents identified adverse economic conditions as one of their company’s biggest challenges, with other issues including governmental regulation (44 percent), human resources (36 percent) and global political instability (33 percent).

About the Survey

The Boyd Center for Business and Economic Research, located in UT’s Haslam College of Business, conducted the survey between July 31 and August 21, gathering responses from business leaders across Tennessee. Respondents represented a broad sample of businesses across all industries, ranging in size from fewer than 50 employees to more than 5,000.

The full set of survey responses is available on the Boyd Center website.

—

Media Contact:

Erin Hatfield (865-974-6086, ehatfie1@utk.edu)