Consumer spending and job gains have slowed in recent months, signaling a stabilization to the post-pandemic economy, according to a new report by the Boyd Center for Business and Economic Research at the University of Tennessee, Knoxville’s Haslam College of Business.

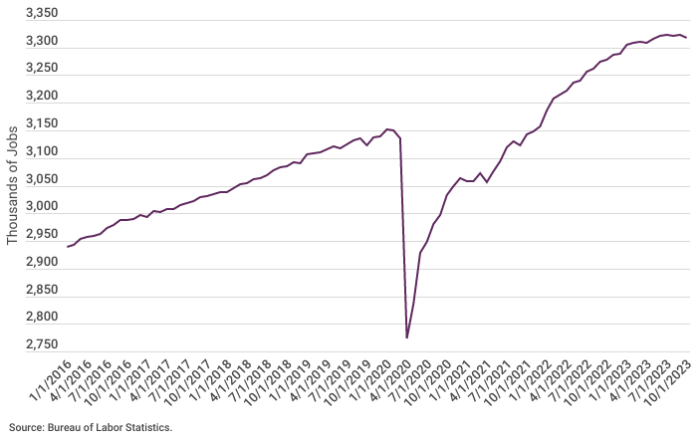

The 2024 Economic Report to the Governor of the State of Tennessee, released today, projects that the state’s inflation-adjusted gross domestic product (real GDP) will grow by 3.3% in 2023 before slowing to just 1.8% growth in 2024. Similarly, the state is expected to add 74,000 jobs this year but then see a moderate addition of 34,000 jobs in 2024.

“This is not a call for a recession, but rather a deceleration to a more stable growth trajectory, following two years of unsustainably strong economic growth,” said Larry Kessler, research associate professor at the Boyd Center and project director.

Job Growth and Gross Domestic Product

Although job growth across Tennessee will remain positive, it is expected to slow. That change could increase the unemployment rate to around 3.5% in 2024 and 3.6% in 2025. Over the long term, Tennessee’s real GDP is expected to increase by 2.4% to 2.5% per year between 2026 and 2030, but an aging population and increasing retirements will cause growth to slow to around 2.2% by 2033.

The U.S. economy is now doing better than prepandemic projections, largely due to high consumer spending. Real GDP in the U.S. is expected to grow by 1.4% in 2024, and the economy will add 1 million nonfarm jobs. The Federal Reserve is expected to cut interest rates next year as inflation remains moderate, boosting the economy slightly in the second half of 2024.

Influx of Tennessee Residents and Business

Tennessee’s economic outlook is more favorable than the national outlook, thanks to an influx of new residents which is driving economic growth and business formation. The state’s population grew by 1.2% between 2021 and 2022, greatly outpacing the nation’s 0.4% growth.

“Tennessee remains a state where companies want to do business and people want to live, thanks to our favorable pro-business climate and exceptional quality of life,” said Stuart C. McWhorter, commissioner of the Tennessee Department of Economic and Community Development. “Our project pipeline is strong, and as we recruit new companies to the state, we will also ensure we are doing all that we can to support our existing businesses and workforce to set them up for success.”

Population gains have led to a large uptick in business formation in Tennessee. Applications for new businesses surged during the first years of the pandemic, and business filings in Tennessee grew by 50% from 2019 to 2022. The growth of online shopping has led to an increase in online business opportunities, and the overhead costs of a brick-and-mortar store and employee wages are often not a factor for online businesses. The number of new business applications began to lessen in 2022, but it is still well above prepandemic levels as a successful shift to remote work has led to even more online business opportunities.

“The number of new business applications remains at historically high levels, which is a testament to the strong business environment in Tennessee,” said Kessler.

Influx of Tennessee Residents and Housing

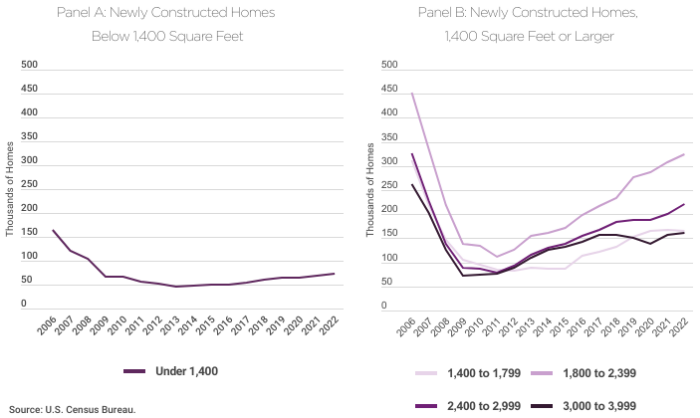

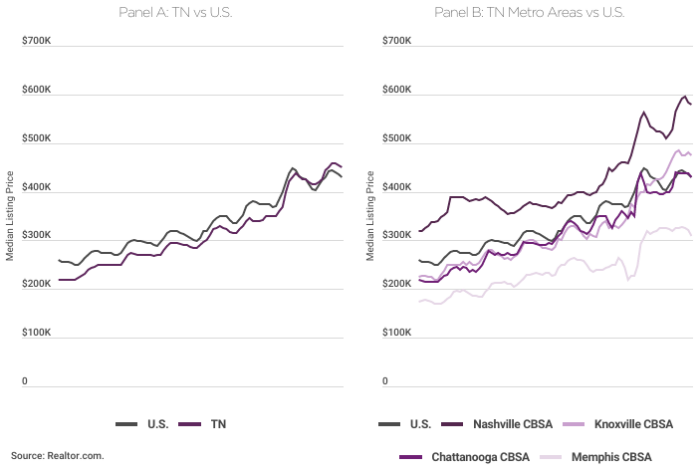

The population increase has also caused growing pains for Tennessee, as home prices in the state have continued to increase the cost of being a homeowner or renter. A shortage of construction workers and available land, as well as zoning restrictions, have contributed to the housing shortage. Rising building costs and tighter profit margins have pushed developers to build larger homes, and the construction of smaller, more affordable homes has dwindled. Additionally, many homeowners refinanced their mortgages in 2020 and 2021 when the Federal Reserve reduced interest rates. Mortgage rates have since increased, discouraging those homeowners from selling.

As of September 2023, median home prices among active listings are roughly $20,000 more in Tennessee than the U.S. average. Home prices are even higher in larger metropolitan areas: Nashville homes are listed at $150,000 above the national rate and Knoxville homes are around $45,000 higher. The rental market has increased as well, with the number of people paying more than $1,500 in rent rising dramatically since 2019. Despite the increased living costs, Tennessee wages are still below the national average, which is putting the goal of homeownership out of reach for many Tennesseans.

About the Boyd Center for Business and Economic Research

The Boyd Center for Business and Economic Research is a nonpartisan research hub within the Haslam College of Business at the University of Tennessee, Knoxville. Its faculty engages in academic research across a wide range of public policy projects, including education, health, e-commerce, taxation, welfare and labor.

Since 1975, the Boyd Center has provided Tennessee’s governor with an annual economic report that includes an in-depth analysis of state and national trends and forecasts.

—

CONTACT:

Erin Hatfield (ehatfie1@utk.edu, 865-974-6086)