Tennessee business leaders are more concerned with filling job openings than recession or inflation, according to the winter 2024 Tennessee Business Leaders Survey conducted last month by the Boyd Center for Business and Economic Research at the University of Tennessee, Knoxville, Haslam College of Business.

Positive Results of Business Investment in Tennessee

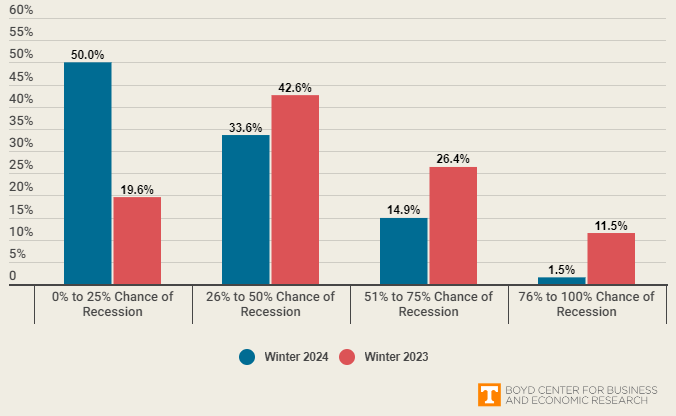

Half of the state business leaders who responded to the survey expressed confidence that there won’t be a recession in the coming year. Last year, four out of five respondents put the likelihood of a recession at 25% or higher.

Less than 17% of business leaders in the January survey said the chance of a recession is 50% or higher, compared to nearly 40% last year.

Employers said they are still feeling the effects of inflation, but not as strongly as they did a year ago. Over 95% of respondents felt Tennessee’s economy is equal to or better than the U.S. economy, and they attributed this strength most often to business investment (47%) and state government leadership (26%).

“The state has prioritized making Tennessee a friendly place to do business, and these survey responses seem to echo that effort,” said Don Bruce, director of the Boyd Center. “Business leaders are leveraging the state’s quality of life and cost of living to attract and retain the skilled workers they need.”

Building Tennessee’s Workforce

About half of business leaders said they struggle to attract and/or retain workers, and many cited housing cost (42%) or availability (28%) as a cause. About a quarter also noted the cost and availability of childcare services.

UT President Randy Boyd welcomes a group of about 50 business leaders and government officials at the beginning of the Tennessee Business Leaders Dinner on Feb. 15, 2024, in Nashville.

The Boyd Center gathered about 50 survey respondents and government officials for a dinner in Nashville last month to discuss the state’s

economy, and the sentiments shared in that room mirrored those of the survey. Despite optimism about Tennessee’s livability and business climate, a shortage of appropriately trained workers and those with necessary soft skills was a recurring subject of conversation.

“Business leaders told us it’s tough to hire skilled workers,” Bruce said. “They need nurses, carpenters, construction workers, laboratory technicians — they’re waiving aptitude tests and diploma requirements, yet they’re still unable to fill the open positions. The workers they do get often lack soft skills and these business leaders find themselves training on the job.”

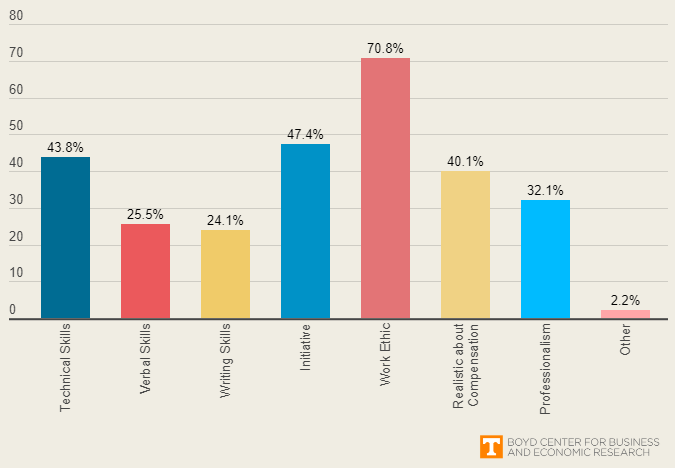

Three in four survey respondents said there were not enough appropriately trained workers for their industry, and half added that Tennessee should improve training and education opportunities to expand the supply of workers. Over two-thirds of the surveyed business leaders (71%) said applicants lack work ethic, but they also cited a lack of technical skills (43%) and initiative (47%), as well as workers being unrealistic about compensation (40%).

Other Challenges and Concerns

Over half of employers cited adverse economic conditions as their company’s top challenge, in line with the results from a year ago. The other top responses have changed, however — nearly half cited government regulation as an issue (up from just 5% last year), and one in three said human resources was a problem (up from 7% in 2023). Last year, almost 40% said the ability to obtain suitable financing was a problem, but that concern has dropped to 12%. Only 4% of business leaders this year said foreign competition is a challenge for their company, compared to over 30% last year.

To improve the business climate, respondents noted that Tennessee should focus on enhancing workforce development (63%), infrastructure development (59%) and technology development (42%). Half of respondents from West Tennessee said the state should provide more business development incentives, while just a quarter from East or Middle Tennessee named that as a priority.

Nearly two-thirds of business leaders said they offered or expanded opportunities for flexible work arrangements; many respondents said remote or hybrid schedules have helped improve their company’s retention, hiring and employee engagement. Nearly 36% said employees do not work remotely, but often this was due to the nature of the job itself. However, some business leaders noted that they had moved away from remote work because of a negative effect on productivity or company culture.

The State’s Economy

Four in five business leaders said Tennessee is on the right track, and they were more favorable about their industry outlooks than they were a year ago. Nearly 90% said their industry will be the same or better over the next year, compared to 80% a year ago. Respondents from West Tennessee have held steady, but those in Middle Tennessee were more pessimistic than a year ago (down nearly 7%), and East Tennessee was more optimistic (up more than 17%).

Other Findings

Almost 40% of business leaders said economic conditions in the U.S. are about the same as last year, and just over 30% said they’re better. Most expect the U.S. economy to improve over the next year, with only 25% thinking conditions will worsen.

Almost half of business leaders expect profitability to grow over the coming year; a quarter of West Tennessee respondents said they expect profitability to grow substantially.

About half of business leaders said they are increasing the use of artificial intelligence, and over 80% said they are offering higher wages to attract or retain workers.

About the Survey

The Boyd Center, located in UT’s Haslam College of Business, conducted the survey between January 10 and 31, gathering responses from business leaders across Tennessee. Respondents represented a broad sample of businesses across all industries, ranging in size from fewer than 50 employees to more than 5,000.

The full set of survey responses is available on the Boyd Center website.

—

CONTACT:

Erin Hatfield (865-974-6086, ehatfie1@utk.edu)